Unlock the full potential of your innovative efforts with Levy Gera, the forefront leader in scaling your growth through UK tax incentives.

Maximise Your Innovation Returns with Levy Gera's Expertise

Recover as much as 33% of your R&D expenses with Levy Gera.

Unlock the full potential of your innovative efforts with Levy Gera, the forefront leader in scaling your growth through UK tax incentives.

Our expert team specialises in R&D Tax Credits, Capital Allowances, Land Remediation Relief, and EIS/SEIS share schemes, ensuring your innovative projects get the financial recognition they deserve.

Maximise The Reward For Your Expenditure In Your Business

Streamline your claims process with our simplified, speedy approach and let our chartered tax, accounting, and technical specialists, along with our legal experts where required, maximise the reward you see for expenditure in your business.

Embrace innovation confidently with Levy Gera and recover as much as 33% of your expenditure on your company's projects in the form of cash credits or reduction in your corporation tax.

Start with a free consultation with one of our experts and discover how you can elevate your company's financial health today.

Why choose us

Maximise Tax Relief

Our experts ensure you reclaim the maximum in R&D tax credits, boosting your business's cash flow.

Efficient Claims Process

With our streamlined approach, we minimise your involvement, making the process hassle-free for you.

Industry-Specific Expertise

Thorough technical consideration, allow you to maximise your tax relief opportunities.

Innovative Growth Support

Our services enable your business to invest more in innovation, driving your long-term growth.

Free Discovery Call

Discover your potential savings with our no-cost, no-obligation review, ensuring peace of mind.

Legal and Technical Support

Chartered tax and accounting specialists, industry specialists and legal experts at hand where required.

Quarterly Tax Insight

Newsletter

Keeps businesses updated with the latest tax relief opportunities, maximising benefits.

Expert guidance - Leverage our team of chartered tax, accounting, and legal experts to navigate the complexities of tax incentives, making the process hassle-free.

Competitive advantage - Gain a competitive edge by leveraging tax incentives to reinvest in your business, driving innovation and growth.

Continuous support - Enjoy continuous support and advice from our team, ensuring your business remains ahead in claiming tax incentives year after year.

Expand business operations - Use the funds recovered through tax incentives to expand your business operations, entering new markets or enhancing product offerings.

No upfront cost - Start your tax incentive claim process without any upfront costs, ensuring you only invest in success.

Accelerate claim process - Speed through the R&D tax claim process with our streamlined service, aiming to get your benefits within 4 weeks.

Maximise tax relief - Unlock your business's full potential by maximising tax relief opportunities with our expert guidance, ensuring you don't leave money on the table.

Maximise innovation funding - Secure more funding for your innovation by maximising your R&D tax credits and other tax incentives with our help.

Simplify claim process - Let us simplify the tedious process of claiming R&D tax credits, allowing you to focus on what you do best - innovating. We do the heavy lifting.

R&D Tax Services

R&D Tax Relief, an incentive under HMRC corporation tax, aims to incentivise and acknowledge companies involved in innovation, irrespective of their size or sector.

Making a claim can provide a significant cash benefit to the company, potentially up to 33% of the qualifying expenditure identified. These cash benefits can be in the form of corporate tax savings (refunds) on tax already paid and/or payable R&D credit.

Companies can also save cash (and use this to continue innovation) by reducing their upcoming corporate tax liability through a successful R&D claim.

Contrary to a common misconception that only companies with research teams in science high-tech labs can claim, the reality is different. Any company, regardless of its sector, spending money on research and development may be eligible for R&D Tax Relief.

Levy Gera supports numerous companies across the UK in various sectors to successfully make claims. R&D Tax Relief can offer support for your growth plans, be it further innovation, growing your team, asset acquisition, or profit extraction.

Client Testimonials

"Thanks so much for this, Aman, was absolutely wonderful through this process. Really happy with our claim, thanks for your help!"

Caroline Fox, Director, Vanishing Point Virtual Production

’At every stage they have been responsive and supportive, from the initial engagement through to smaller follow up queries. Their produced work is consistently high level and they have really put their work into making it an entirely seamless and low-touch process for us. I would have no hesitation in recommending them. ’’

Jason Scheiner, Fyrtorr

"Look no further. Very efficient and always at the end of an email. Leaving you in good hands here."

Jamie Wykes-Hobday , Social Station group

Schedule A Call

By providing my phone number, I agree to receive text messages from LGTB Limited. Including appointment reminders & responses to missed calls. Message and data rates may apply. Message frequency varies. Text HELP for help. Text STOP to unsubscribe.

Is the process for claiming R&D tax credits complicated?

No, our expert team simplifies the entire process, ensuring claims are expedited and hassle-free, we aim to have your claim prepared within two weeks.

Can small businesses also benefit from your services?

Absolutely, we support businesses of all sizes across various sectors to maximise their tax relief opportunities efficiently.

Isn't hiring a tax recovery company expensive?

Our no upfront cost model means you only invest in success, we win when you win. Our fees are derived solely from the value we provide our clients.

What if my company hasn't innovated enough to qualify?

We offer a free consultation and work with your competent professionals to assess your eligibility and often uncover qualifying activities many businesses overlook.

Are the tax incentives you specialise in applicable to my sector?

Yes, we support a wide range of sectors, including various multi-disciplinary niches, ensuring that regardless of your sector we try to identify opportunities your company can utilise.

Will working with you disrupt my business operations?

Our simplified claim process and dedicated team ensure minimal disruption, allowing you to focus on your core operations while we handle the claim. We do all the heavy lifting.

How long does it take to see returns on our claim?

With our streamlined service, we aim to have your claim prepared within 2 weeks. From submission you can expect HMRC to process this within 4-6 weeks.

What makes Levy Gera different from other tax recovery firms?

With a full team of chartered tax and accounting specialists, together with technical industry specialists and legal experts at hand where required, Levy Gera helps hundreds of companies unlock rewards for their commitment to hard work and innovation. Our fees are solely derived from the value we offer our clients.

Changes to Research & Development

April 2024

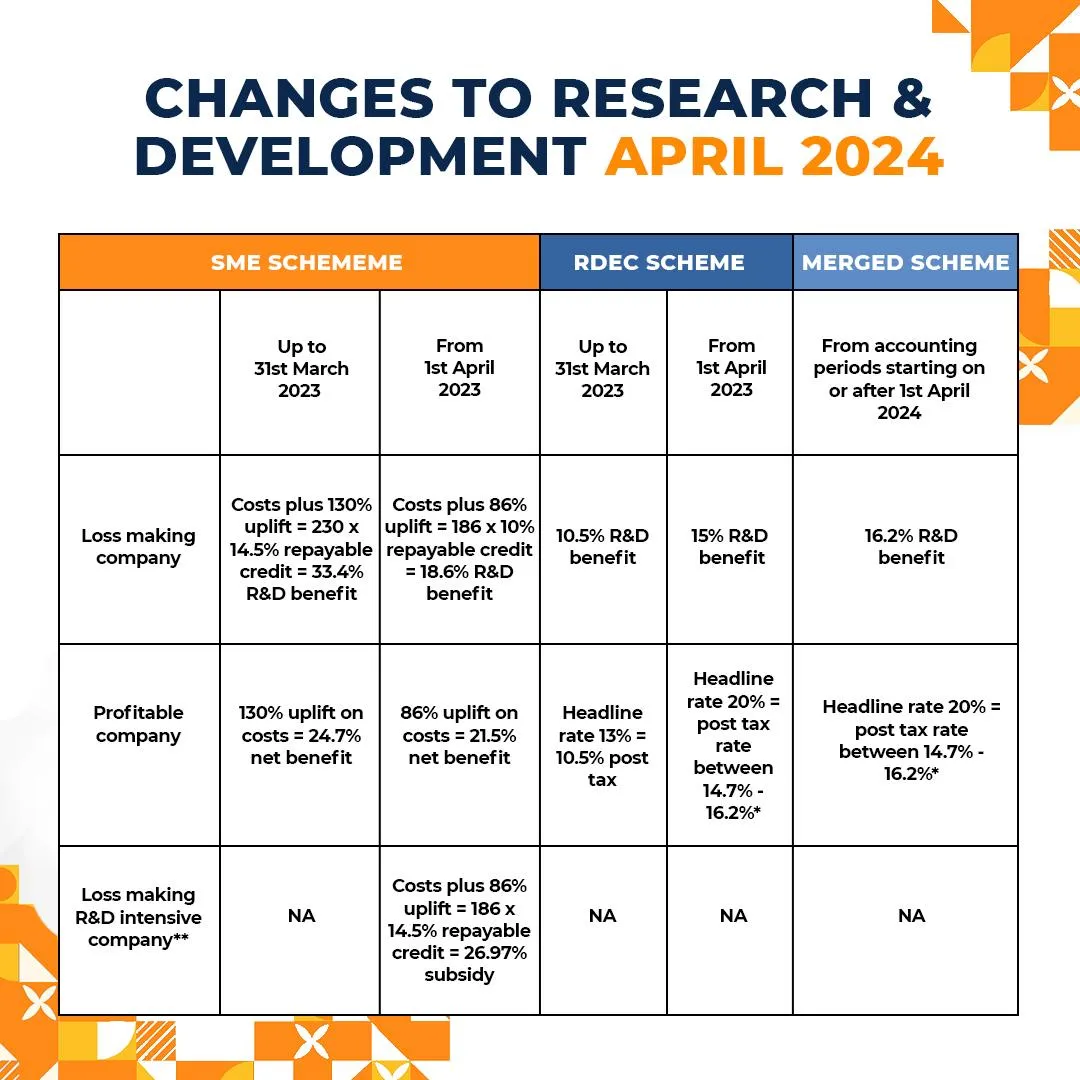

In the 2023 Autumn Statement, adjustments were outlined to simplify and enhance the R&D tax incentive program in the UK. The following amendments were enacted and came into force from April 1, 2024.

These changes include the amalgamation of the SME and RDEC schemes, the discontinuation of claiming overseas R&D expenses, and the reduction of the intensity threshold from 40% to 30% for the SME R&D intensive scheme, which was introduced from April 1, 2023.

The most significant proposed alteration involves merging the SME and RDEC schemes into a single streamlined scheme, enabling all companies, regardless of size, to claim under the same framework. This adjustment applies to accounting periods commencing on or after April 1, 2024, impacting companies with accounting periods ending on March 31, 2025, initially.

For companies presently utilising the SME scheme, there will be modifications to how R&D relief is treated. Currently, it is accounted for 'below the line,' below the profit before tax. However, under the unified scheme, the R&D credit will be recognised 'above the line' as other income. This change is due to the RDEC credit being subject to corporation tax, necessitating its inclusion within the profit before tax figure and the merged scheme will follow this methodology.

The below table delineates these modifications and their financial implications for future claims.

Claim Tax Relief - Strategic R&D Tax Advice

With our award-winning team unleash the power of R&D tax incentives and ensure you’re getting the reward you deserve.

Best Tax Recovery Services Company 2024 - Business Elite Awards